Payments Without Platforms

The “Creator Economy” has a liquidity problem.

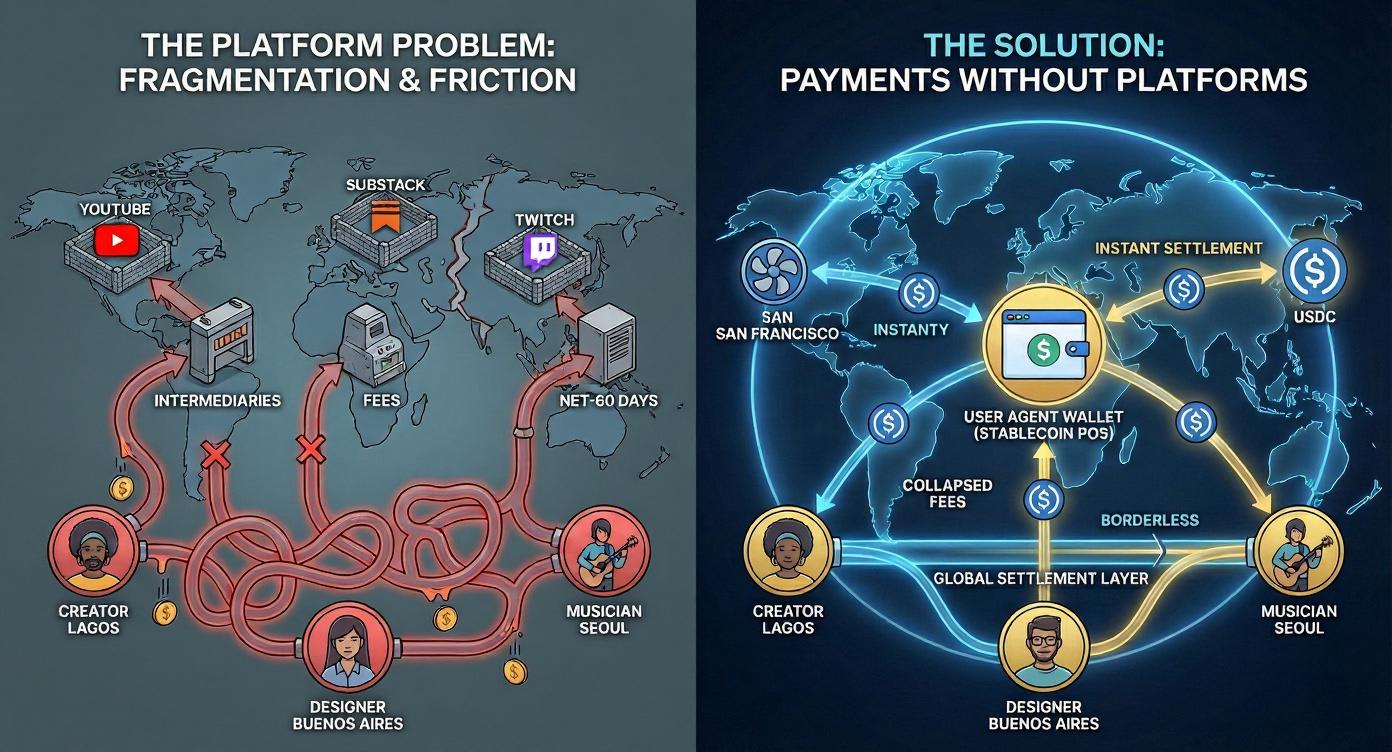

We have spent the last decade solving the Distribution problem. Today, a developer in Lagos, a designer in Buenos Aires, or a musician in Seoul can reach a global audience of millions on X, YouTube, or Twitch. The pipes for content are frictionless and borderless.

But the pipes for value are broken, high-friction, and strictly bordered.

If that developer in Lagos wants to get paid by a fan in San Francisco, they hit a wall of intermediaries. Twitch takes 50%. The local bank takes a wire fee. The currency exchange eats 3%. And the settlement takes Net-60 days.

We have built a Global Information Network on top of a Local Banking Network. The two are incompatible. This mismatch is the single biggest cap on the GDP of the internet.

The Fragmentation of “The Cash Register”

The current solution is what I call “Platform Payouts.” Every platform (Substack, Patreon, YouTube) acts as its own Merchant of Record. They build their own walled garden of credit card processing.

This creates Payment Fragmentation. A creator effectively operates ten different small businesses. They have a “Substack Business,” a “YouTube Business,” and a “Twitter Business.” None of these cash registers talk to each other. You cannot use your YouTube earnings to unlock a Substack post. The capital is trapped in the silo where it was earned.

For the user, it is worse. To support five different creators, you need to enter your credit card five times, manage five subscriptions, and trust five different databases with your PII (Personally Identifiable Information).

The Stablecoin Unlock

The solution is to decouple the Content Layer from the Settlement Layer. Content should live on the Platform. Payments should live in the User Agent (the Browser).

This is the structural reason why Stablecoins are the most important innovation in fintech since the credit card.

Forget the volatility of crypto markets for a moment. Functionally, a Stablecoin (like USDC or a purely algorithmic dollar) is simply HTTP for Money. It is a permissionless, global standard for moving value that does not care which country you are in or which platform you are using.

When you integrate Stablecoins into the browser:

Settlement is Instant: The “Net-60” wait time vanishes. The creator gets paid the second the work is consumed.

Fees Collapse: You bypass the “Interchange Tax” of the credit card networks and the “App Store Tax” of the mobile OS.

Geography is Irrelevant: The developer in Lagos has the same receiving address capability as the developer in San Francisco.

The Wallet as the New POS

In this model, the Browser Wallet becomes the universal Point of Sale (POS) terminal.

Imagine reading an article on a news site. Instead of hitting a paywall that asks for a credit card and a monthly subscription, your browser simply “streams” a few cents of Stablecoins to the author’s wallet for the minutes you spend reading. Then, you switch to a video stream. Your wallet authenticates you and streams a tip to the creator.

The platform (the website) focuses on hosting the content. The browser (the user agent) handles the commercial relationship.

The 1 Billion User Opportunity

This matters because the next billion internet users are coming from regions with high mobile adoption but low banking penetration. They cannot use Stripe. They cannot use PayPal. But they can use a non-custodial wallet.

By moving payments out of the “Platform” and into the “Infrastructure,” we unlock the latent GDP of the global internet. We move from a world of Siloed Subscriptions to a world of Fluid Value.

The platforms won’t build this; it breaks their lock-in. The banks won’t build this; it breaks their fees. It has to be built by the User Agent.